There are several different places you can find your Account Number and the LLCU Routing Number. The quickest way to find the LLCU Routing Number is to look at the top of any webpage at llcu.org. (Scroll up now, if you'd like!)

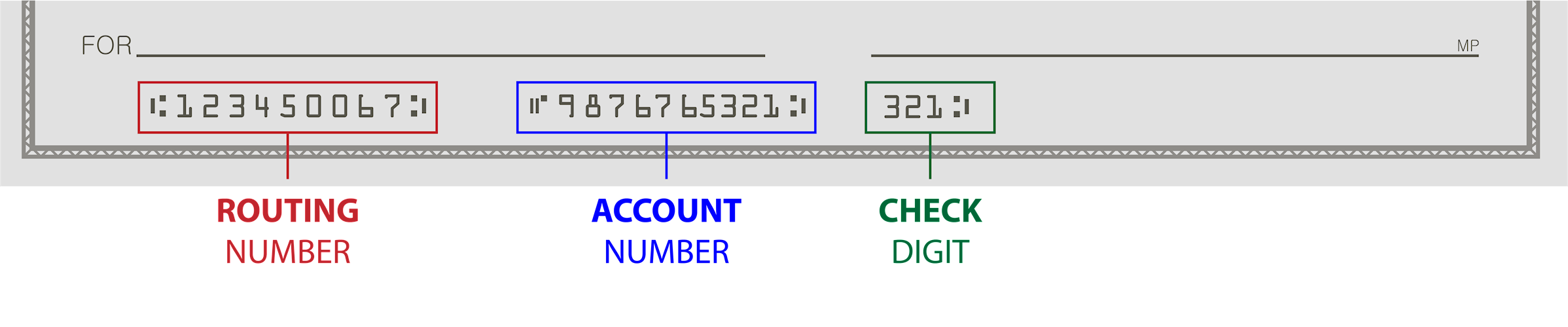

Another fast and easy way to find BOTH your Account Number & the LLCU Routing Number is to look at the bottom of one of your paper checks. Under the memo line, you will find a series of digitally printed numbers. The LLCU Routing Number is listed first and found in between two colons. The second set of numbers is your personal Account Number.

If you are enrolled in Online Banking, you can also find your Account and Routing number there. To find the LLCU Routing Number, once logged into Online Banking, scroll to the bottom of the page and click on "About Us". The next screen will take you to the LLCU website and the Routing Number is listed at the top. To find your Account Number in Online Banking, login and then click on the account for which you'd like to locate the full number. Then, click "Account Information". Your full account number will show on the next screen.

If you are enrolled in Mobile Banking, you can easily locate both numbers there, as well. Simply login and click on the Account for which you need the full number. Next, click on "Account Details" and the Routing Number and Account Number are on the next screen. To view the ENTIRE account number, you may need to click on the EYE icon to reveal the full number.